Dave Matthews Little Feet Little Hands Little Baby

Have you heard of Dave Ramsey's baby Steps?

Dave Ramsey is a world-renown personal finance adept who created 7 steps to help people have a roadmap to get their finances in lodge.

These same baby steps actually helped me pay off of $52,000 of consumer debt in just 18 months.

In this article, I am going to go over each step in item. I'll explain how they piece of work and what you should wait out for.

In This Article

- Who is Dave Ramsey?

- Video Review of The Dave Ramsey Infant Steps

- What Are The Dave Ramsey Infant Steps?

- one. Save $1,000

- ii. Pay Off Debt

- three. End the Emergency Fund

- 4. Maximize Retirement Investing

- 5. Fund Kids' College

- 6. Pay Off Home Mortgage

- 7. Build Wealth and Give

- Exercise Dave Ramseys Infant Steps Work?

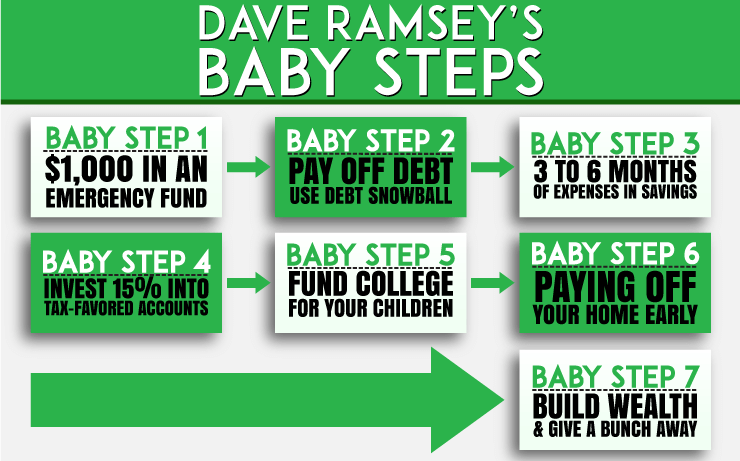

- Dave Ramsey Baby Steps Infographic

- Summary

Who is Dave Ramsey?

Dave Ramsey is a personal finance skilful who is near known for his pop radio show chosen The Ramsey Prove.

It is currently syndicated nationally in the The states on over 600 radio stations and has over 16 million listeners per week.

He is as well behind the popular budgeting app, EveryDollar which helps people stay on rail when they are following his baby steps.

Lastly he is a New York Times best selling writer of multiple books.

Here are his most popular books:

- Fiscal Peace

- Total Money Makeover

- Entreleadership

- The Legacy Journey

Video Review of The Dave Ramsey Baby Steps

What Are The Dave Ramsey Infant Steps?

- 1. $one,000 in an Emergency Fund

- 2. Pay off debt using the Debt Snowball

- three. Put iii to 6 months of expenses in savings

- 4. Invest 15% of income into retirement

- five. Fund College for children

- 6. Pay off your home early

- 7. Build wealth and give a bunch abroad

Prepare to learn more details of each stride? Let's get!

The Breakdown of Each Infant Step

I desire to aid you lot figure out where y'all are in the process. This is important. Let'southward starting time with a breakdown of what each baby step entails. See where you're at and leap in on the stride from there.

1. Save $1,000

Dave calls this step the "babe emergency fund." It might seem silly to start by socking a thou in the depository financial institution.

After all, you could be putting that coin toward reducing debt. Merely Dave has some good logic backside this start babe footstep:

"Unexpected expenses happen to everyone. And for some reason, they tend to happen more than when you've just committed to getting out of debt.

In order to avoid beingness tempted to use your credit cards to handle these unexpected costs, save a quick $one,000 and put it aside as a buffer from those emergencies."

And so what happens if y'all're paying off debt and you have an emergency? Use some of the money in your starter emergency fund.

Stop paying extra on your debt for now. Pay cash for your emergency from the fund. Then, put whatever actress money into a high yield savings account until it reaches $1,000 again.

Later on it's at $1,000 once again, you can resume the debt snowball. Handling emergencies this way will help ensure that your credit card balances continue to become down. They won't go up due to emergencies.

Bonus: The starter emergency fund serves equally preparation ground for paying for emergencies in cash. It helps you develop a habit of saving money likewise.

At some signal, you'll abound your emergency fund to a higher balance. Later on y'all do that, you tin can start making your money work for yous. How?

2. Pay Off Debt

The debt avalanche (paying off debts according to the highest interest rate) will save money in the long run.

However, the debt snowball is oft a better choice for debt payoff. Why? Because it keeps people motivated.

Getting debt complimentary is a long journey for many. The debt snowball gives you quick wins from the outset. The quick wins can motivate you to stay the course.

What is the debt snowball method?

Here is how its works:

- List your debts from smallest to largest

- Brand the minimum payment on all debts, except the smallest i

- Put whatsoever actress funds toward the smallest debt until information technology'due south paid in full

- Tackle the side by side smallest debt on your list with all your extra greenbacks

- Echo this until information technology all debts are paid off

Cheque out our free debt snowball calculator here.

Bonus: Being able to marker those smaller debts as "Paid in Total" faster volition motivate you. Information technology'll give you faith that yous can indeed win the battle against debt.

Download the Debt Snowball form hither.

3. Finish the Emergency Fund

Ramsey'south adjacent suggested baby step is to increase your emergency fund. You'll salve until it contains 3 to half dozen months' worth of household expenses. It might seem daunting to save that much money.

However, Ramsey has a method for doing information technology apace. If you've finished Babe Step 2, y'all are gratuitous of consumer debt. The only debt yous have left should be mortgage debt.

Next, you'll take the coin y'all were using to pay down debt. Don't coast on your new, smaller payments.

Instead, have the money and make a "payment" to yourself. Use the money that y'all were putting toward your debt snowball.

Make regular savings account deposits with it. Doing so should assistance you stop your emergency fund faster.

A 3 to 6 month emergency fund volition keep you and your family protected. You'll have a overnice buffer against major fiscal emergencies. Troubles such as job layoffs and major dwelling house repairs won't require credit cards. Instead, y'all'll pay for them with cash.

Bonus: Developing a addiction of saving BIG money will make you into a rock star saver. It'll brand it easier for yous to save for big things. Nosotros put coin into a separate countdown fund for expected major expenses.

And so we tin can pay greenbacks for things like cars and vacations. Learning how to save big money helped us practise that.

4. Maximize Retirement Investing

Look at you now! Your consumer debt is gone. You take an emergency fund that's fully funded. It contains 3 to 6 months' worth of expenses.

Adjacent, Ramsey suggests maxing out your retirement investing.

For 2020 this means contributing up to the legal maximum immune by the IRS. That maximum is $nineteen,500 a yr for 401(one thousand)'southward and $half dozen,000 a year for IRAs.

Ramsey suggests saving 15% of your income.

If you tin can exercise that without going over the IRS limits, go for it. Note that those l and over tin can add more cash to retirement accounts.

- $6,500 to their 401(k)

- $1,000 to their IRA holdings.

These are called "catch-upwards" contributions. If yous can make them, do it. Maxing out your retirement investing helps ensure your aureate years will exist secure. The more y'all relieve, the more comfortable you'll exist.

five. Fund Kids' College

There's i matter I like well-nigh the college department of the Total Coin Makeover book. Ramsey is articulate that college doesn't guarantee career success for your kids.

He goes into nifty detail most how important it is to calculate the price vs. the benefit of college. Do this before you transport your kid out to spend $25,000 a yr on schooling.

It's of import during this stride to talk with your spouse. Determine how much money you can afford to set aside for your kids' education.

The dollar corporeality is upward to you. Be sure you research the unlike college saving options too. Brand sure what you lot plan to contribute to your kids' college educations is affordable for your family.

In addition, make your plan articulate to your kids. They should know what to look from yous where higher financing help is concerned.

As a final tip, consider college alternatives. Y'all may end up saving big coin in the process.

Here are some ideas:

Consider Trade School

Your child may be happier in a trade school. He or she might be meliorate suited for a trade.

At that place is a shortage of workers in fields like:

- Electric

- Plumbing

- Heating, ventilation and ac

- Construction

And other trades. Because of the shortage, merchandise schools are often cheap. And they're paying large salaries to those working in trade industries.

Talk to your child regarding their interests. They might prefer a trade over a desk task.

Your child may be able to complete general classes at a community school. Community colleges are cheaper than universities.

Come across if your child can take some classes at a community college. Only cheque with his/her academy to ensure the credits will be able to transfer.

Research Scholarships

Foundations and companies everywhere offer scholarships. Your local college fiscal aid part can assistance besides. Scholarships tin can become a long mode toward paying for higher costs.

Using these tips can help y'all minimize college debt. Or you may be able to avoid it birthday.

vi. Pay Off Abode Mortgage

So you've paid off all of your consumer debt. You've got a fully funded emergency fund. You're contributing at least xv percentage of your income toward retirement.

In addition, you have a plan for contributing to your kids' college educations. What's adjacent? It'due south fourth dimension to pay off the mortgage faster.

Can you imagine beingness mortgage free? Non owing anybody annihilation? They say the grass feels different under your anxiety when you own your home. Now it's time to notice out.

You've created a solid budget so that you know where your money goes. Now take all of your extra funds. This includes funds that were going toward your debt snowball. And the amount you were putting in your emergency fund.

Put it all toward that mortgage loan. Become it paid off in total as soon as possible. Put whatever extra money toward the mortgage loan too.

Actress money could include:

- Gifts

- Tax refunds

- Work bonuses

- Overtime pay

And any other money you don't ordinarily get. Since information technology'due south unexpected money, you lot won't miss it. Don't spend it on other stuff. Instead, apply information technology to go that mortgage gone.

The less interest you pay to the bank, the more money you lot have. You tin can requite it to worthy causes and use it to fulfill your dreams.

Information technology's your chore to find out what those dreams are. Which leads to Baby Step #7.

7. Build Wealth and Give

Here's the all-time step! At least in my humble stance. You don't owe coin to anyone. And you lot've got a prissy stockpile of savings.

What does that mean? It'south time to start building some serious wealth.

That wealth-building can come in a diversity of forms. You tin invest in mutual funds. Or, you can invest in existent estate. If y'all desire, yous tin sock the money away in a high-interest earning bank.

The goal is to put equally much coin every bit possible toward whatsoever your financial goals are. That might mean traveling the world. Or it might mean edifice your dream domicile. Perhaps you desire to alive life equally a philanthropist.

Y'all're completely debt gratis. Now you're working at having clustered a serious amount of wealth. The globe is your oyster, and your dreams are unlimited. How does that audio? Good?

Do Dave Ramseys Babe Steps Work?

From my first-mitt experience, I can say YES, the baby steps do really work. Not only did it help us become debt costless, I have been able to see other friends and family get debt free as well.

It does take work on your part to get the results, but if yous work the steps, the results will follow.

Dave Ramsey Baby Steps Infographic

Summary

Start working the baby steps in your life today. Nosotros used these steps personally to pay off our debt and start building wealth. If we tin can do information technology, you can to.

Start taking the necessary steps to improve your finances today with Dave Ramsey'south Baby Steps.

Source: https://wellkeptwallet.com/the-dave-ramseys-baby-steps/